Amazon Prime Day has become quite the phenomenon. Introduced by Amazon in 2015, this annual (sometimes biannual) shopping event offers deals to Prime members only, combining both exclusivity and heavy discounts to amp up demand.

But with the cost of living crisis and people cutting back – particularly on subscription services – how has 2023 fared? And what can it tell us about potential shopping behaviour as advertisers prepare for Q4?

Amazon Prime Day 2023: how did it shake down?

Amazon Prime Day has consistently surprising sales figures. Year after year, the event has driven a surge in Amazon’s already unfathomable revenue, demonstrating the immense buying power and loyalty of Amazon’s Prime members.

So was 2023 any different?

Setting the scene

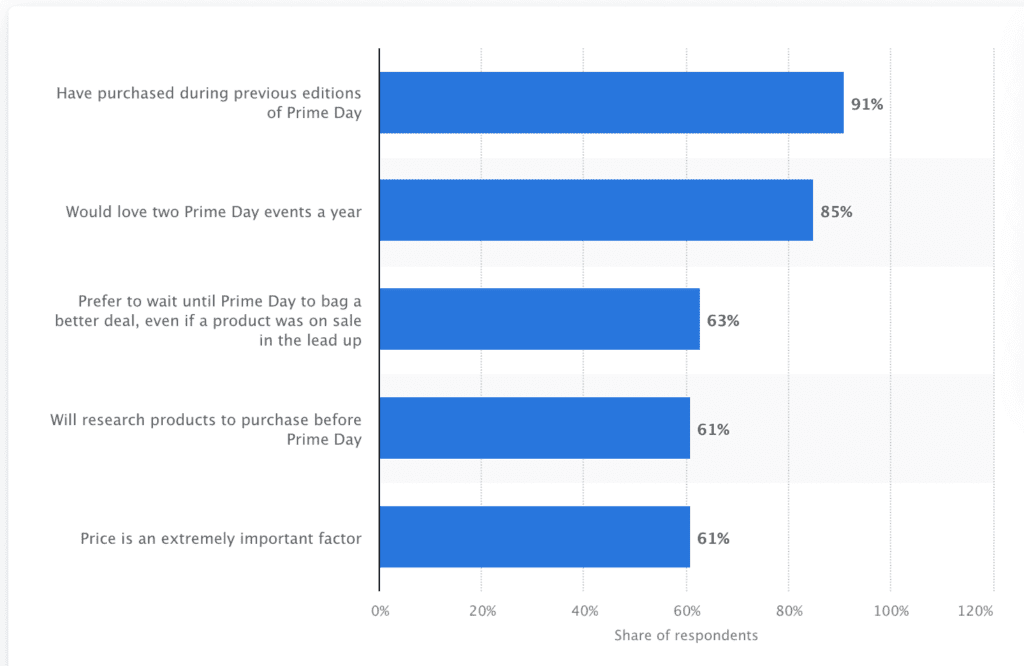

Let’s start with some behavioural insights:

- 52% of consumers planned to shop on Amazon Prime Day 2023 in the UK

- Nearly half of Prime buyers planned to spend the same amount they had last year

- 61% of people research the products they want to buy ahead of the event

So not only were shoppers primed (sorry) and ready to shop, they planned in advance what they wanted specifically, and how much budget they’d have ready for it.

So intention was high, but how did Prime day actually go?

How did Prime Day compare to 2022?

Amazon Prime Day 2023 saw online shoppers spend over £1.15bn in the UK, up again from the previous year.

Category-wise, toys and homeware enjoyed the highest sale growth – a good indication of where consumers are looking to bag a bargain. It’s interesting that there seems a renewed focus on the home, as we saw in Covid.

State-side, behavioural insights suggest that people are using such shopping ‘events’ to grab the things they really need (rather than want) at a good price, with a significant chunk also using ‘Buy Now, Pay Later’ initiatives. That might not be such good news for luxury goods retailers as the cost of living continues to bite.

So people are being more intentional, they’re still prepared to spend, but the cost of living remains a real bone of contention. Still, Prime Day sales hit their best-ever figures – so where does that leave your ecommerce strategy?

Adapting your paid media strategy for Black Friday

Consider exploring Amazon Ads ahead of and during holiday seasons

According to Statista: ‘sponsored ads shown on amazon.co.uk in 2022 led to outstanding growth sales during Prime Day. That year, attributed sales grew by 283 percent on Amazon’s UK platform, compared to the preceding 14 days to Prime Day. This represents an increase from the 157 percent growth registered the previous year.’

If ever there was a time to trial the platform, it’s before Prime Day (to build your data) and during Prime Day (to convert those shoppers).

Have confidence: appetite is still strong

Every year, it’s predicted that interest in Black Friday, Prime Day and Christmas sales will wane. So far, we’ve yet to see it happen – even in the face of rising interest rates, ‘greedflation’ and a cost-of-living crisis.

Shoppers are however getting more savvy and more intentional. That means impulse buys could be down – but if they’re in your market, you’ve got a great chance at converting.

Brand awareness and remarketing will be crucial

With shoppers planning further ahead, you’ll want to be front-of-mind for when they’re ready to convert. Brand awareness ads will naturally get your business in front of customers, and if they show interest by clicking, you’ve just got yourself an excellent audience to remarket to in the run-up to the big shopping days!

Watch your data, too. With consumers researching ahead of time, if you notice a fair amount of hits/interest on particular products in the lead-up to Black Friday, that could indicate serious demand and consumers ready to pounce on a deal.

Highlight benefits beyond price

Google suggests you should also be clearly stating your non-price differentiators. Things like speed of delivery, delivery price, and generous returns policies can all work magic when it comes to getting the sale.

High basket abandonment rates might mean you have a potential friction here, so if possible, consider how conversion-friendly your policies are when consumer demand is at its highest. Competition during these periods goes beyond price.

Closing thoughts

Embracing the lessons from Amazon Prime Day, you can navigate the challenges and reap the rewards of the holiday shopping season. The key lies in strategic planning (well ahead of time), making data-driven decisions, and having a customer-centric approach.

Want more in-depth guidance about making the most of high-demand periods? Join us at our upcoming event in Bristol on 12th October: The CMO’s Guide to Peak Performance. We’ve got speakers from Google, Pinterest and The Natural Adventure Company so you can hear how platforms and brands alike. Hear from the Launch team how to master peak demand, get the chance to ask questions, and network with fellow marketing leaders navigating the same challenges as you – register your place today.

References

- Google, Connect with early holiday shoppers

- Statista, Share of consumers planning to shop on Amazon Prime Day

- Statista, Opinions and shopping habits during Amazon Prime Day 2023

- Statista, Number of items purchased by Amazon Prime members worldwide

- Statista, Amazon Prime Day in the UK – Statistics and facts

- Statista, Sales on Amazon Prime Day in the United Kingdom (UK) in 2022 and 2023

- Statista, Change in Amazon Prime Day sponsored ads spending on amazon.co.uk from 2019 to 2022